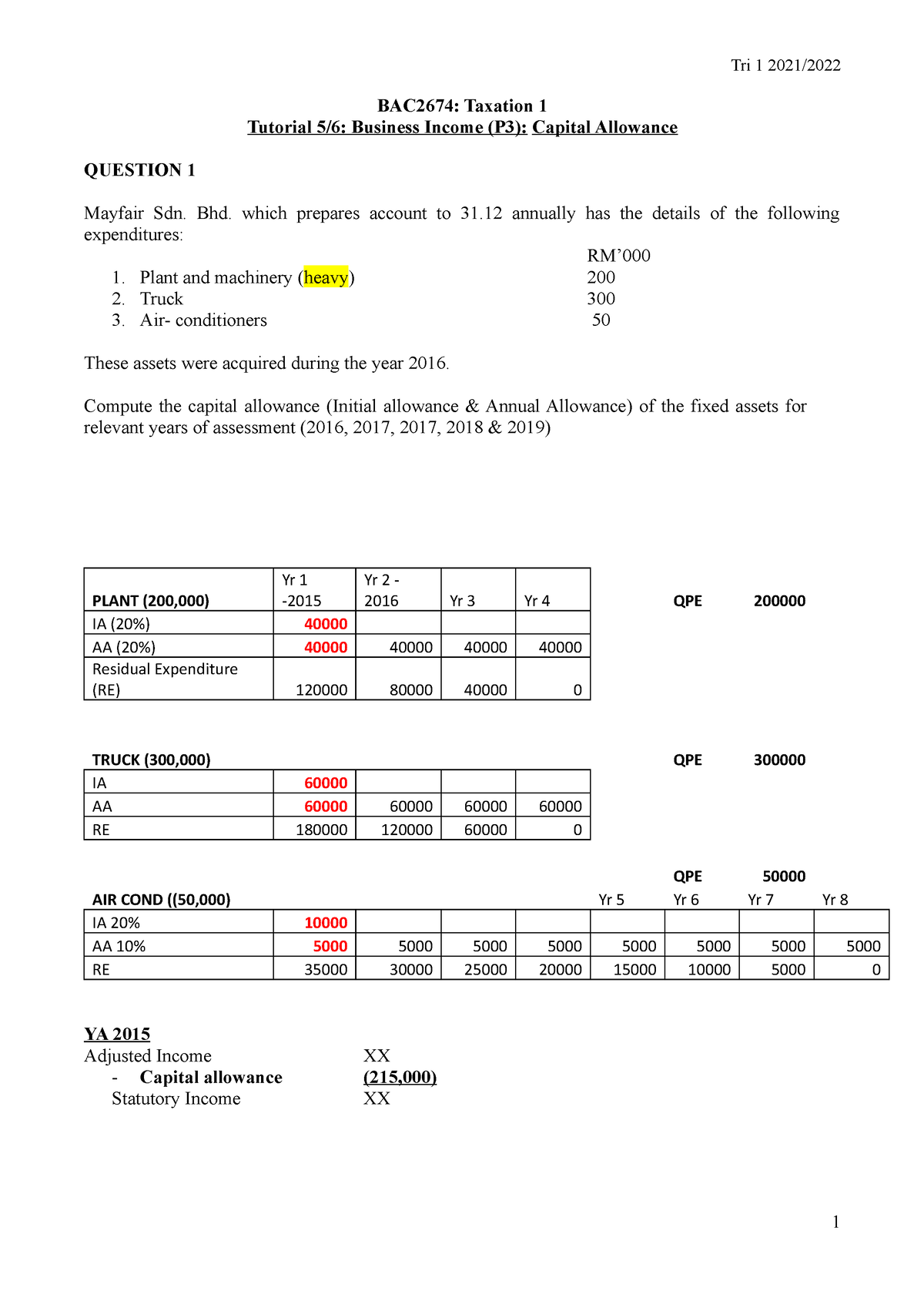

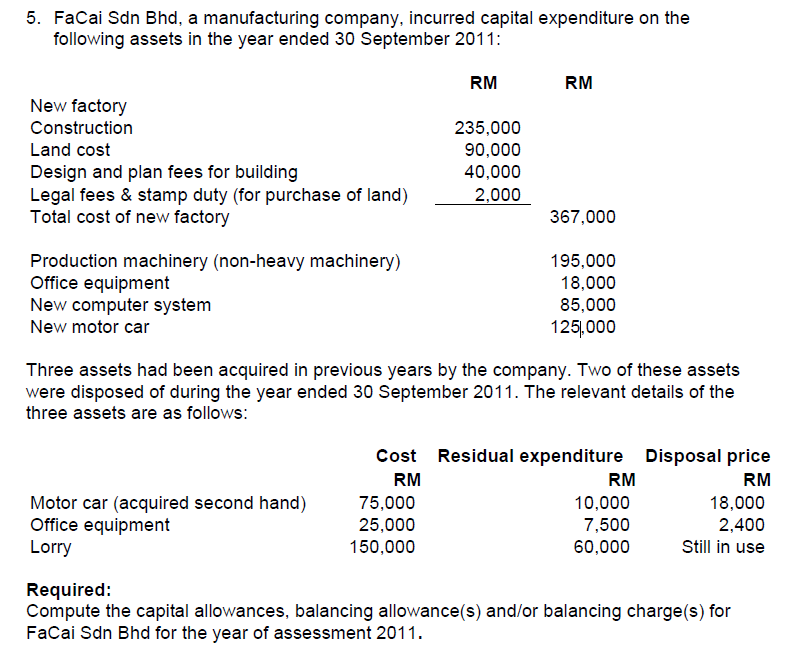

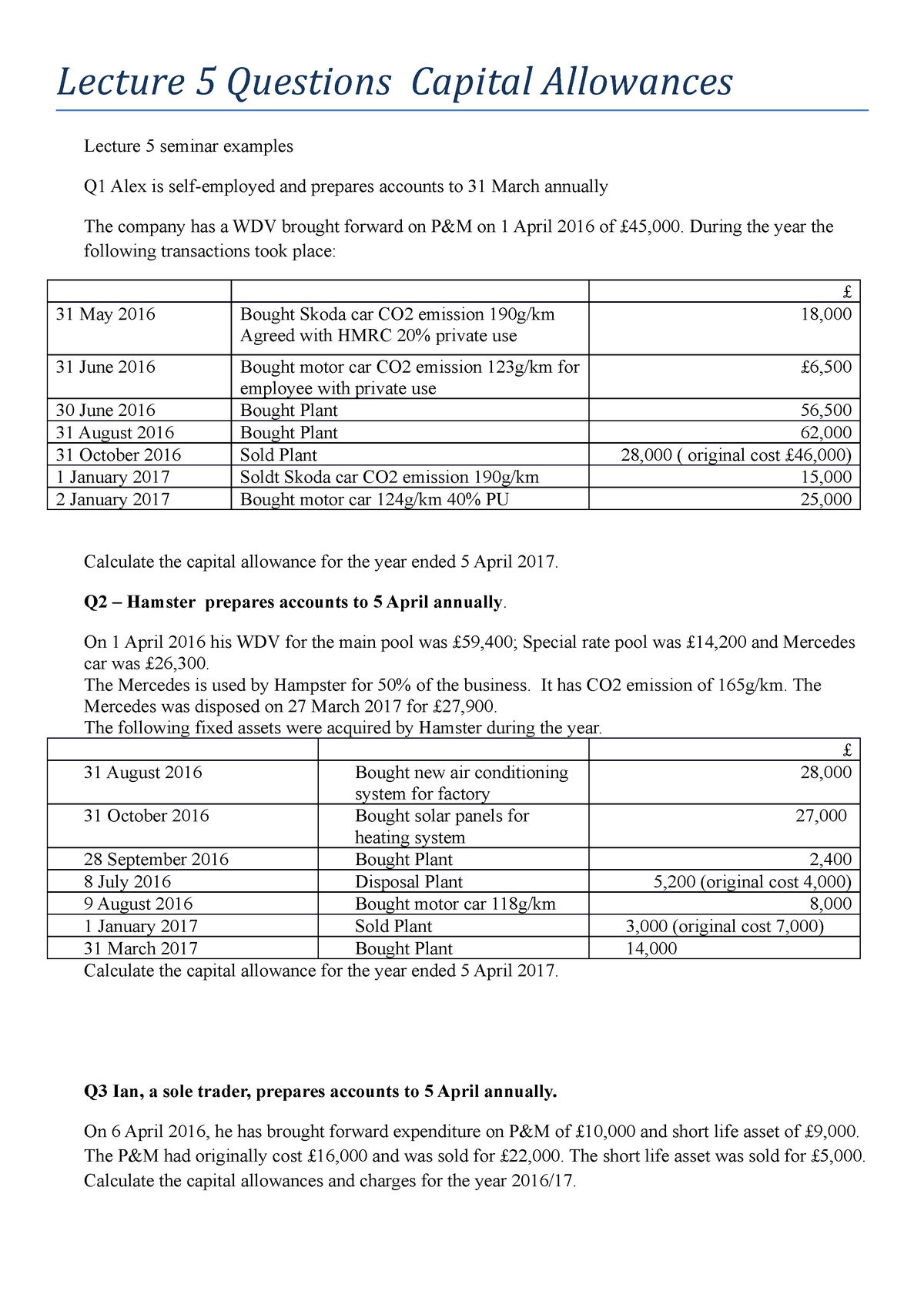

05 Capital Allowances seminar Questions 2016-17 - Lecture 5 Questions Capital Allowances Lecture 5 - Studocu

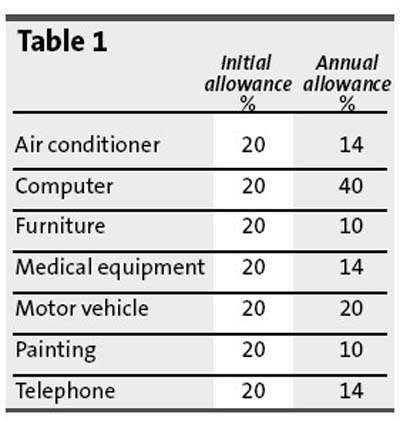

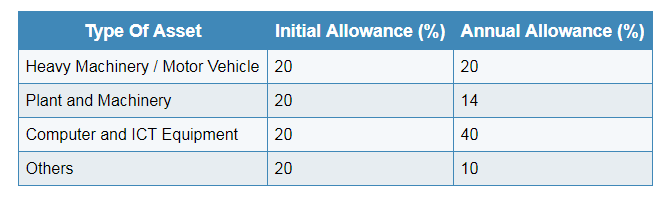

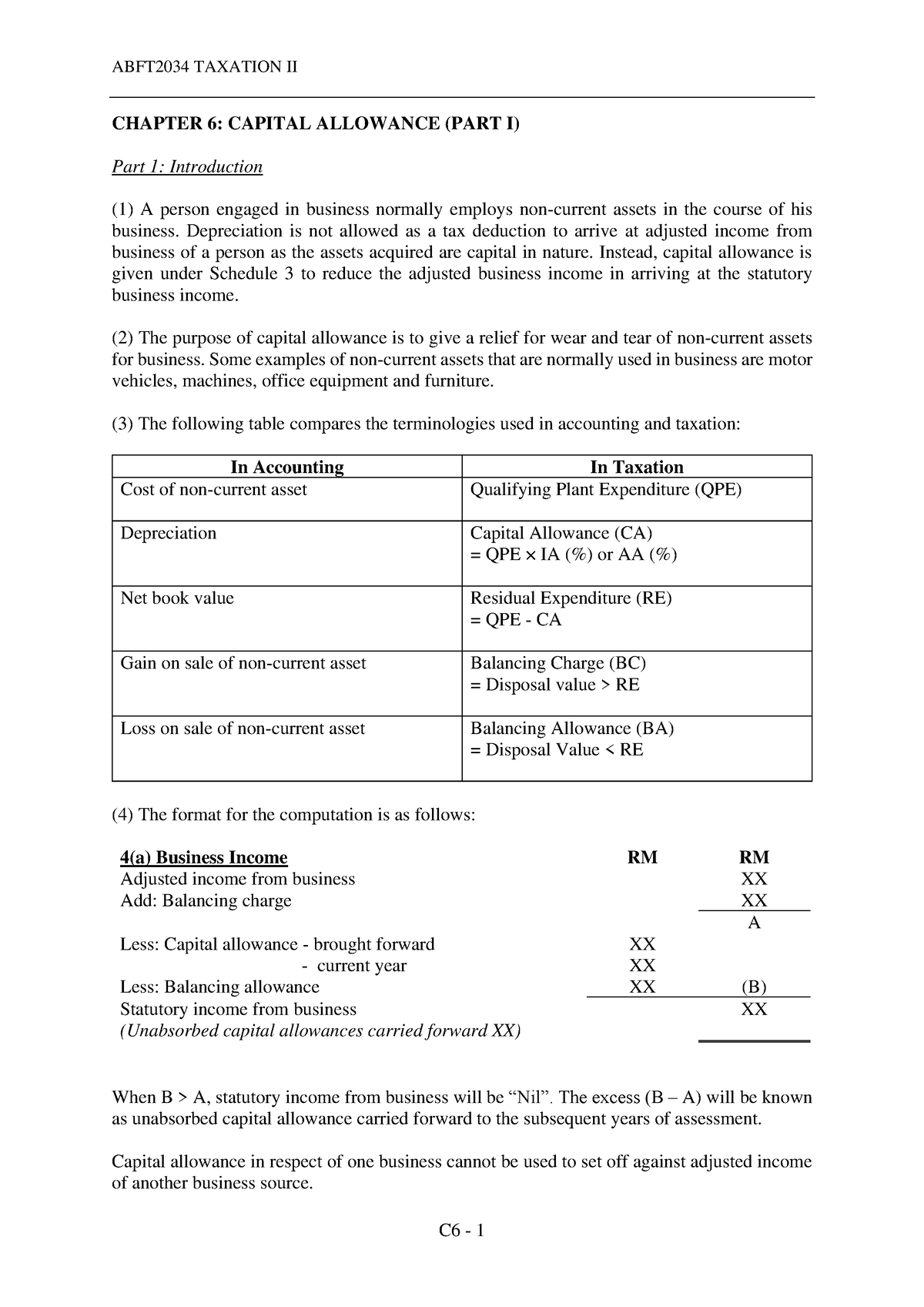

ABFT2034 Chapter 6 CA (Part I) - CHAPTER 6: CAPITAL ALLOWANCE (PART I) Part 1: Introduction (1) A - Studocu

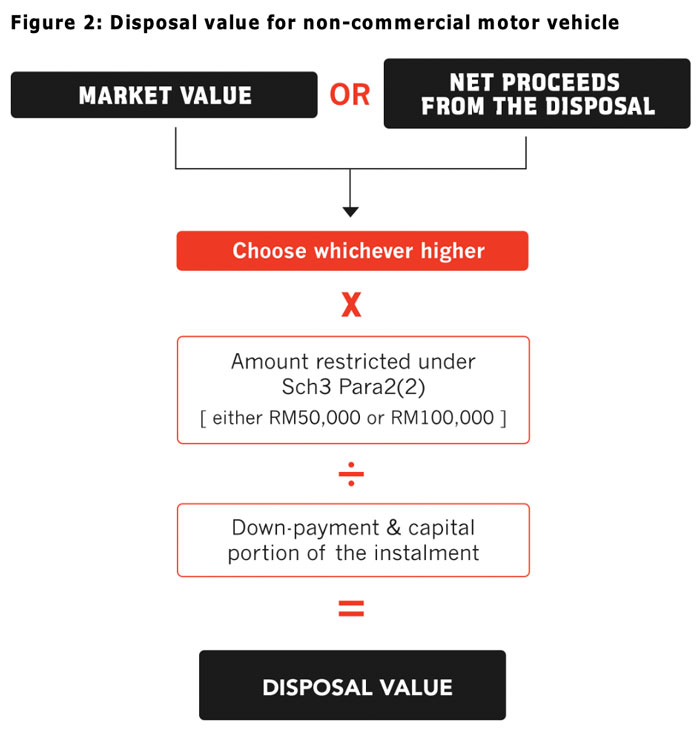

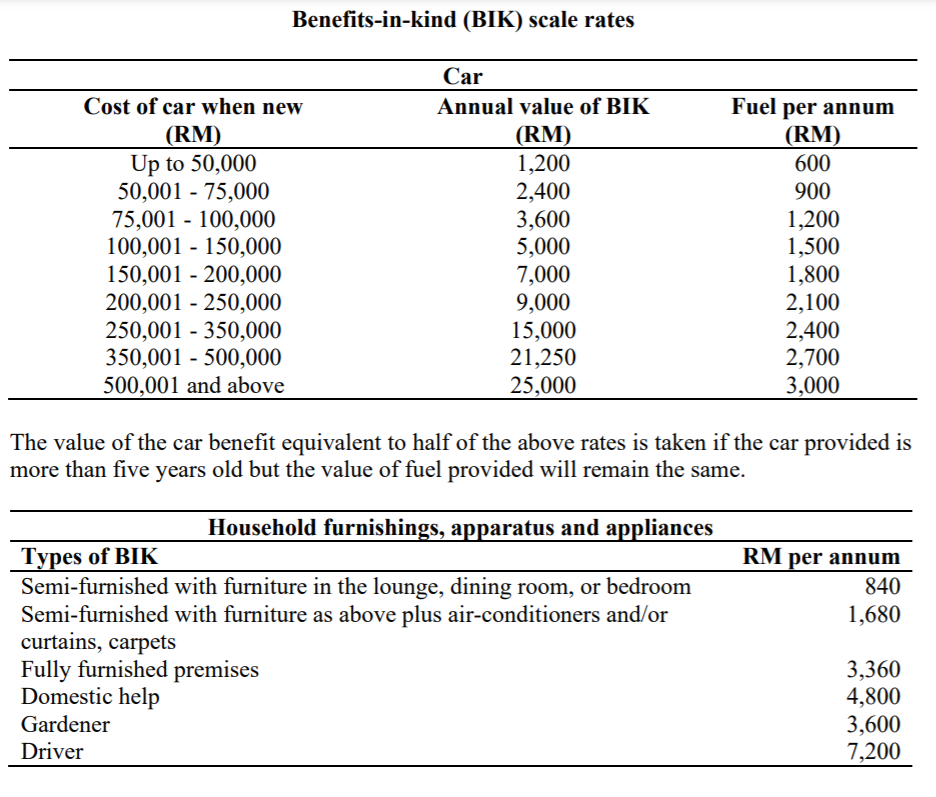

Can I buy a Personal car under a Company and Claim Tax Deduction? - Feb 11, 2022, Johor Bahru (JB), Malaysia, Taman Molek Service | THK Management Advisory Sdn Bhd